Market Update

Oversupply Growing

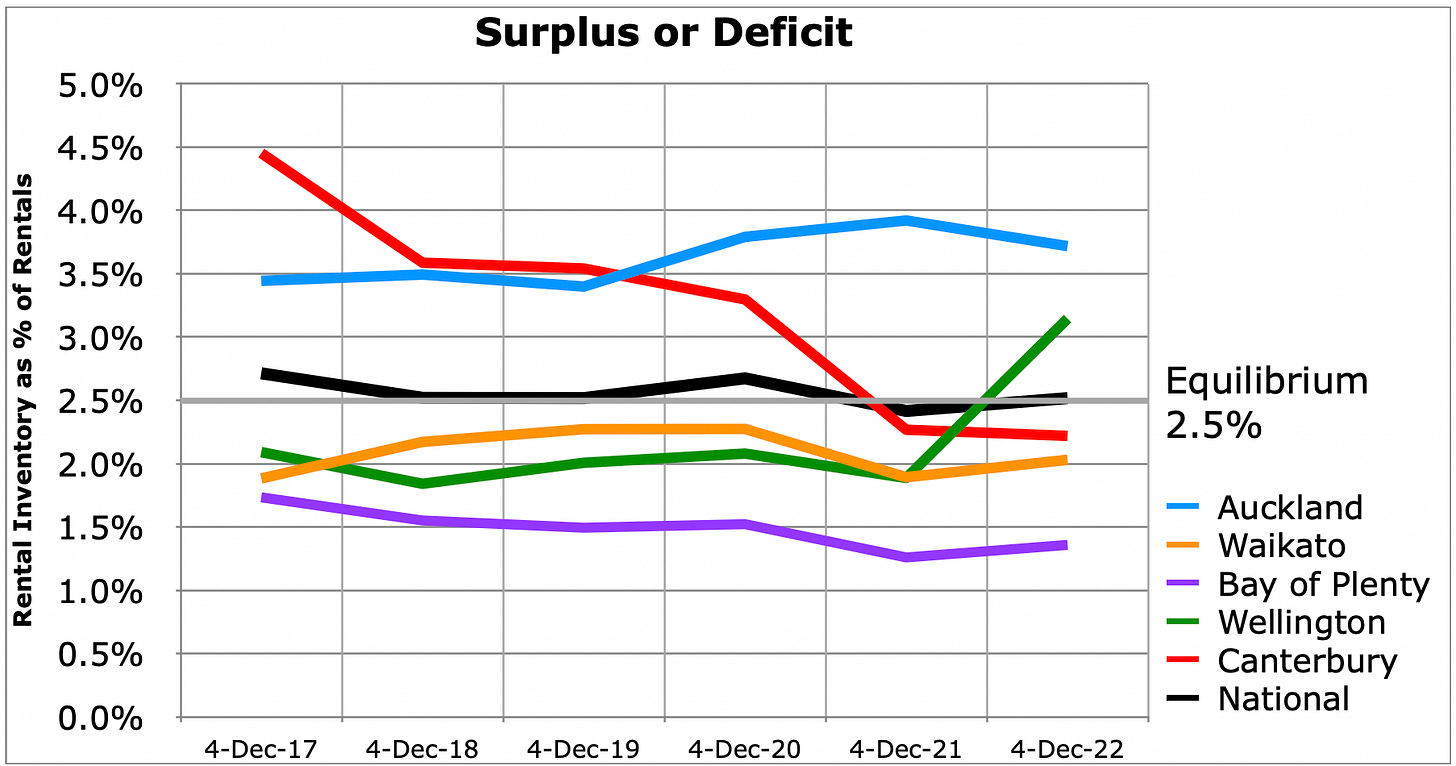

Property market inventory is extremely regionally dependent. Some regions clearly still are short of rental accommodation, while others where investment has been the most intense are now showing oversupply. Wellington is by far the most extreme, with inventory in both sales and rental markets pushing prices lower.

The NZ regions chart shows the story for the major regions, I keep this updated on my home page. As previously, my research over the last decade shows that when inventory:

exceeds ~2.5% rental prices fall relative to Household Incomes

is less than ~2.5% rental prices rise relative to Household Incomes

We have enough homes available for rent in NZ, it’s just that they are in the wrong places.

The chart shows:

Auckland for a few years and this year Wellington where inventory is rising, so rents are falling relative to HH income

Christchurch (Canterbury) where inventory is now low so rents/HH income have risen slightly recently after falling while inventory was high

Bay of Plenty where inventory has remained very low for years and rents/HH Income rose well above the long term average in 2020.

Waikato has both low inventory and low rents/HH Income, proximity to Auckland may mean inventory levels are shared between the two regions.

Wellington

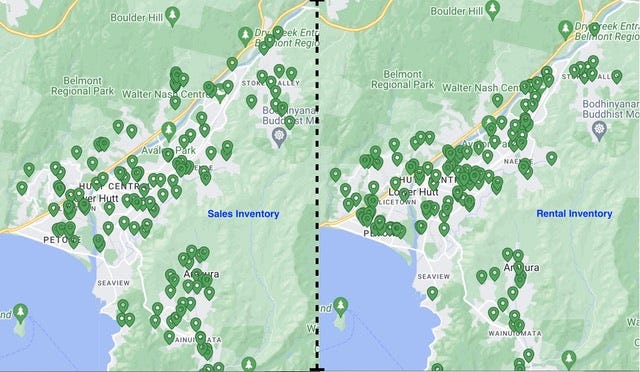

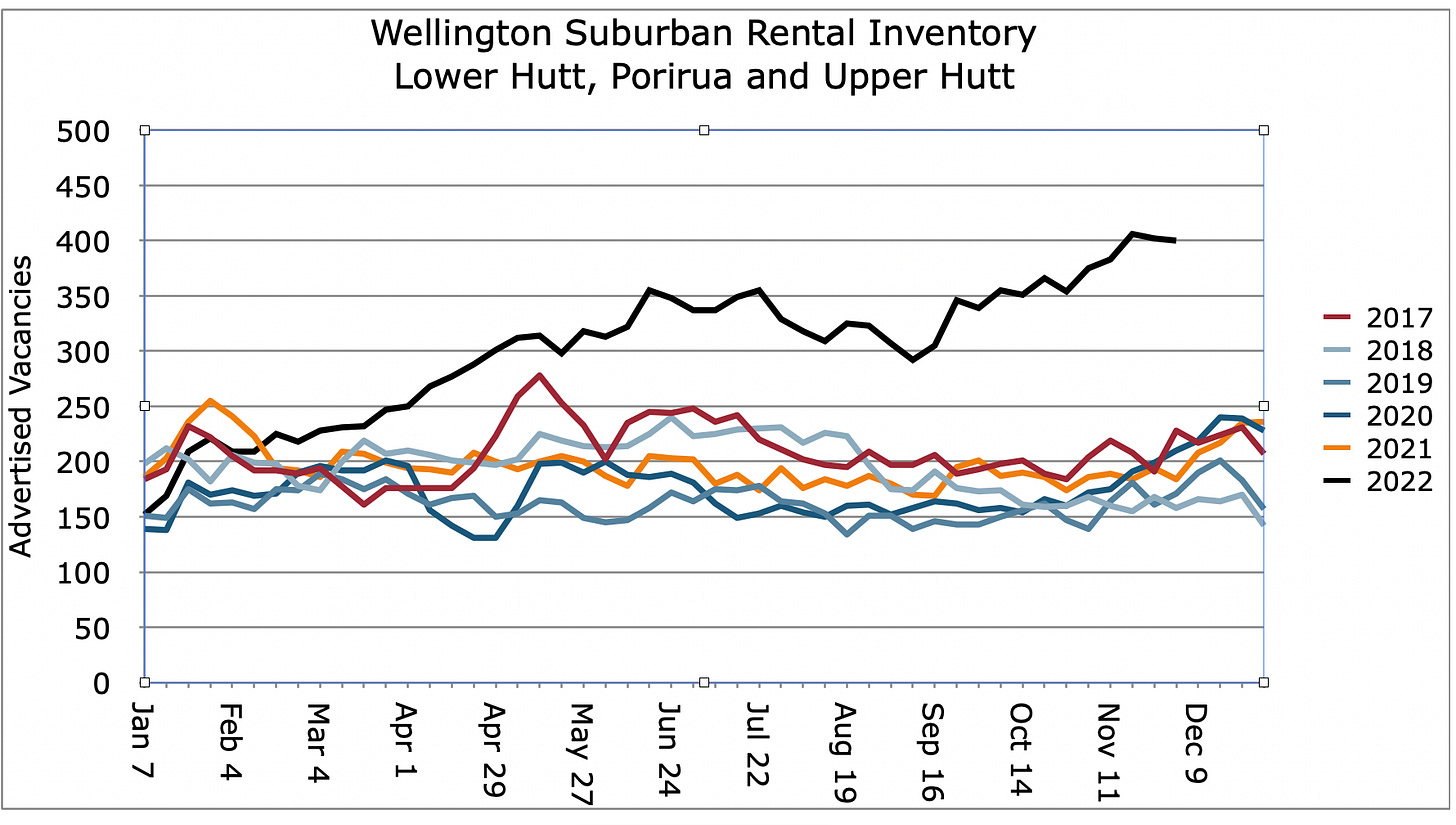

I gather a lot more information on Wellington, which is the region where most change is occurring at present. Wellington has an excess of properties for sale as well as and excess of properties for rent. Rental inventories are again testing new highs compared to previous years. Oversupply is driving both property values as well as rents relative to HH income lower

The most extreme is Lower and Upper Hutt, both with very fast growing increases in properties for rent (Rental Inventory)