Table of Contents

My Data Information - Vacancy Rates

Historically a vacancy rate of 2.5% is close to balance in New Zealand. The New Zealand rate is currently 2.28%, ie very close to a balanced rate. Australian cities are apparently hovering around 1% but that information depends on their realestate website, the equivalent NZ site also quotes data from their own advertising but forgets to mention they have less than 60% of the market.

NZ seems blessed with enough supply, although some regions have too much supply (Auckland 2.80% and Wellington 2.82%) or too little (Waikato 1.46%, BoP 1.78% and Canterbury 1.78%). The following chart is for the current month (April at time of writing) each year, and shows the situation in each of the main regions compared to the national average. However, NZ measures move outside my green shading 2.3-2.7% vacancy rate for short periods, maybe the shading is too restrictive.

Auckland and Wellington are our biggest rental markets by far and are both a little oversupplied. Waikato and BoP have had low vacancy rates for years, and prices reflect that, rising much quicker than other regions. Canterbury had an oversupply in 2016 after overbuild by uncontrolled government support after the earthquake, which resulted in a severe loss of builders and confidence which in turn led to undersupply. Otago is a university city and so undersupply may simply be a seasonal issue, I don’t know.

Comparing to previous supply - this is less reliable but interesting

Over or undersupply is shown below for each region compared to previous years, not my magical 2.5% formula. This chart compares current supply with average supply at same time every year for the previous 5 years. Positive numbers such as for Wellington mean relative over-supply, negative such as Canterbury is the level of relative undersupply (shortage). Caution though, this compares with 5 years of data and so any over or undersupply in that 5 years will distort the results. For those familiar with my charts, the same detail is in the chart below the table;

These numbers actually confirm the chart above, apart from Otago (student demand?) and Waikato & BoP. Waikato & BoP supply seems wrong, I would expect both regions to show negative supply based on the 2.5% factor above, however they have had an undersupply for a long time so the current supply may be just relatively better than the 5 year average.

We have a minor oversupply of rental inventory, The national supply is very close to balance with demand. Increasing supply as mooted by government requires funding for more builds. Only public building of rental units would do this, private investors should not build in an oversupplied market because reducing returns are guaranteed.

Rental Impact of Supply

Geometric mean rents* (GMR) follow household incomes and have done so since the earliest data in 1998. ie rents as a proportion of Household Incomes are a consistent measure of market performance. There are minor variations from my shaded green balance area in the chart below, this is always related to over or undersupply.

Auckland may be a special case, the economists are arguing that the change is due to changes to the RMA, I’m not so sure, oversupply was a major impact in 2021-22, then undersupply in 2023 then high migration just filled inner-city empty homes and we are quickly heading into oversupply again. The change last year could simply be the oscillations caused by a disturbance which is still finding equilibrium.

Auckland is now near balance.

BoP is clearly undersupplied yet advertised properties are higher than the past 5 years.

Canterbury and Waikato rents are a little low, but are close to balance.

Wellington has an oversupply so prices are low compared to incomes

Wellington Rental Inventory is 38% greater than demand.

Wellington inventory data shows an oversupply of homes since early 2022. Last Monday Wellington had 1,383 homes for rent compared to a 5 year average of just 999. The national oversupply is 727, so Wellington has over 50% of the national oversupply using this measure, countered in the main by Canterbury and Auckland.

Wellington is about the same size as Christchurch or Hamilton but has a very tight CBD because of geography and so central land prices are very high. This means apartment blocks are popular but one apartment block can create most of a 300 home oversupply. Apartment construction starts have been limited for a year so the oversupply is probably temporary.

As you can see in my chart below for CBD rental inventory, oversupply became an issue in Feb 2022. All other parts of Wellington are holding about the same as the last 5 years, supporting my conclusion that apartments are leading the way.

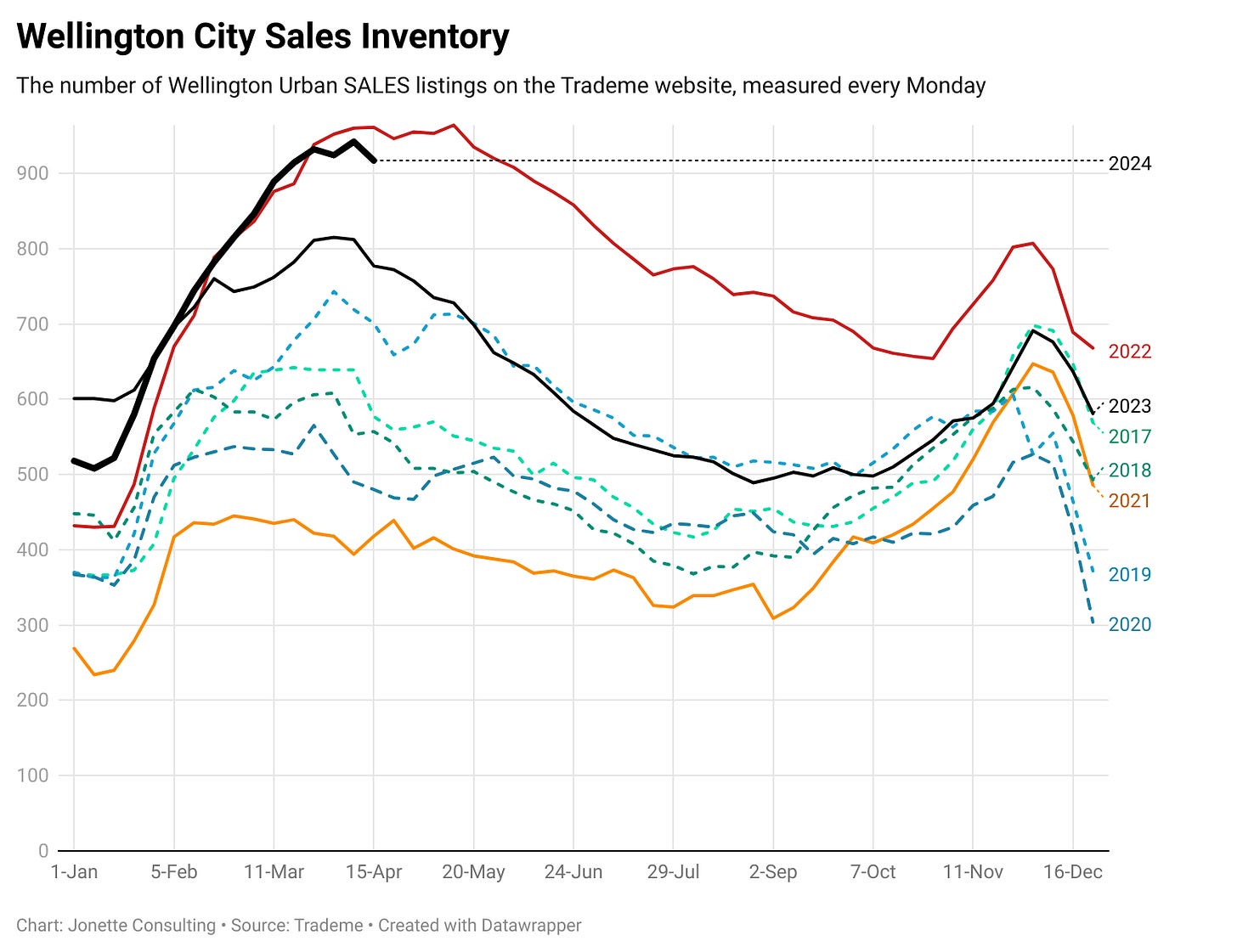

The sales inventory for Wellington City (CBD and suburbs) has peaked but unfortunately I do not keep sales data on the CBD, as I do for rentals, so this is not quite comparable. However suburban Hutt and Porirua are still rising so I expect South Wellington and Tawa are also rising countering the CBD influence which is very likely to be pulling them down.

Rental prices in Wellington Region are static since 2022, because supply is so far ahead of demand. This is the 3rd year where average February geometric mean rents quoted by MBIE are almost exactly $600pw. The chart below shows Wellington Rents by year and by month - read up between the lines to get a feel for annual changes, along the lines to see the seasonal changes.

Christchurch may be short by 16% or 184 rental properties but;

From the top chart it seems a good time to increase your rental holdings in Canterbury. However the inventory chart below shows equilibrium over the last 3 years so the comparison to 5 years is too long for Christchurch at present.

Canterbury rental inventory is about the same as the last two years, after a decline in 2021. This will be pulling the 5yr average down so it is not a great time to invest in Christchurch.

Canterbury GMR is rising with a big gap from Feb 2023, is this due to either shortages of properties for rent or rising incomes in Christchurch. I believe the latter because Christchurch HH Incomes have risen nearly 9% in both of the last 2 years.

Bay of Plenty oversupplied by 31% but by small numbers

The current oversupply at 31% is only 100 homes, but very close to a record as seen below. The key information may be the growth rate, the market has changed from severe shortage to almost the top of oversupply in just 7 weeks. Something new has happened, maybe a release of an apartment block? I recall an office block being converted recently but do not have facts.

The Bay of Plenty (both Rotorua and Tauranga) are renowned for shortage of rentals but this can become remembered reality and not relevant today - hence I use weekly data. The current rental inventory is growing very quickly. I would not want to invest here yet until the line stabilises or rises above the 2018 line which was only beaten in 2015. Note BoP are heading into their highest season for inventory, I guess that’s tourism impact but do not know, comments below may help.

Nationwide oversupply by just 8%

I doubt this is helpful for anyone but media but here it is, I only have rental inventory;

I plot these as weekly charts by each year so that you can see how inventory matches with each year as well as any seasonality. There is no fancy maths, it is just a record of the data.

For the record oversupply is by 8% , and as above the whole of NZ is not showing much over-supply of rentals. The chart has just 727 greater than the 5 year average of 8,670 homes at this time of year - very close to the 2017 number but less than 2022.

National Household income appears to be growing quickly

Rents are very clearly driven by household income with a bit of pressure from either over or undersupply. Household incomes are rising much faster than in the past so this may be the main driver of rents since supply is almost balanced.

The following chart shows the history of household income growth for Auckland and Wellington, the two major drivers of National household income. Last year, 2023, saw the highest growth ever for Wellington (June 2023; $2,717pw) as well as the massive growth over 3 years for Auckland (June 2023; $2,493). It may be prudent to assume these regions will not be growing quite so quickly this June year but Auckland rental growth suggests otherwise. Wellington rentals are static so maybe incomes are down as well as oversupply up. My growth assumptions for Wellington household income is 4% and Auckland 5%, this will be wrong, but which way?

If you have read this far, congratulations, this is a bit longer than usual as I have tried to cover the misinformation being spread about NZ homes supposed undersupply. I do not have sales inventory for all of NZ but I do for Wellington. I have all of NZ for rental inventory.

We have a very small oversupply of rental property inventory but too close to call anything but “in balance”. Definitely NOT an undersupply as many are touting for whatever reason.

Sales inventory also looks likely to be close to balance, I believe Auckland is close to balance but only from anecdotal stuff, I hope to get better data shortly.

Conclusion

It is a great line to say we need 100,000 new homes built when the private market has no need for new homes. Building more rentals will be unlikely through private effort since investors returns (prices) would be reduced by overbuild!!

Only the government can increase rental inventory in this environment by building more social homes. However that is now very difficult since Kainga Ora, the only active government development agency, has already ceased development and building.

Kainga Ora development staff may already be redundant, delaying any reconstruction effort. The last attempted rampup of public construction in 2017 after a bust period was delayed by years because Kainga Ora started with zero development expertise. Considerable growth in expert staff to rebuild a division in Kainga Ora has of course led to poor contracts with high prices during the boom and slow builds. Hopefully NZ finds a leader with a very clear vision of how to keep the market moving rather than the boom and bust of past decades.

*Geometric mean rents is a measure that removes the impact of small samples having an outsized impact on an average. Think of the impact of a rent of $2,000pw in an area where say 10 rents are $600, a pure average would be wrong. Or say we only took average February rents in Wellington during student rental period where 4-5 bedroom homes are commonly rented, the GMR corrects that anomaly.

Fascinating as always John,

I wonder whether the assertion of undersupply is a reflection on "affordable" (i.e. lower price) rentals available, rather than rentals overall. Not sure that it's possible (whether data or person time), but I wonder what the 2.5% would look like in different e.g. market quartiles. If all the over-supply is in upper quartile apartments, that's unlikely to quickly trickle down into improving supply in lower quartile family homes?

Hi John, thanks for sharing this work you do. Question: how have you factored in population increases/decreases in these areas over the years into your over/under supply?